MetaTrader 4 (MT4) has become one of the most widely used platforms for forex trading due to its accessibility, advanced tools, and adaptability. Whether you are a novice trader or a seasoned professional, understanding how to leverage MT4 effectively can elevate your trading game. Here’s a guide to maximizing your success using metatrader 4.

Why Traders Rely on MetaTrader 4

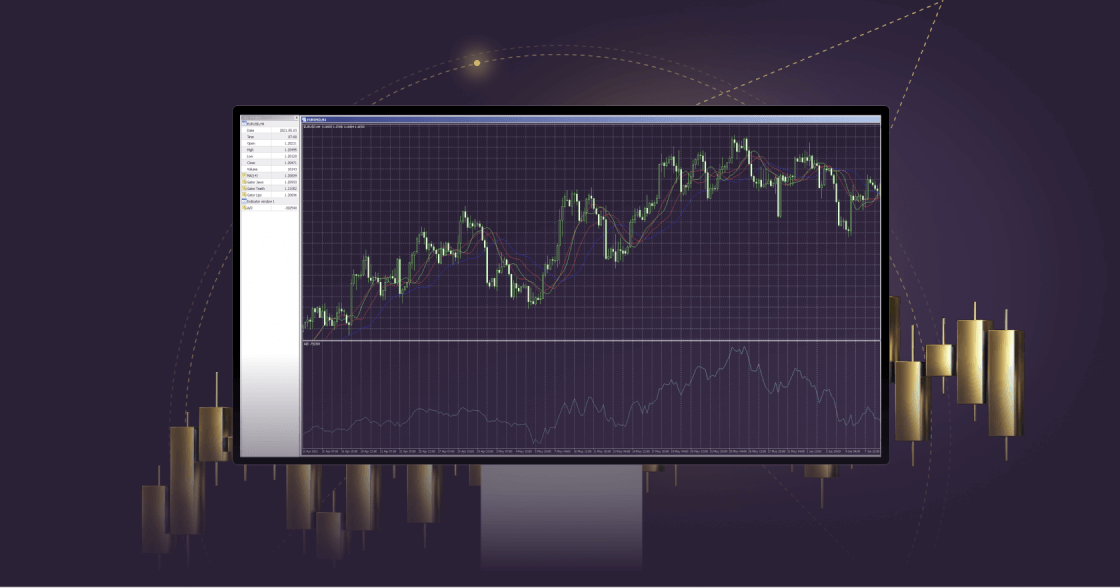

MT4 stands out because of its user-friendly interface and comprehensive features. Its ability to integrate technical analysis tools, custom indicators, and automated trading mechanisms makes it ideal for traders at all experience levels. Successful traders often prioritize platforms that offer versatility and real-time data management, two areas where MT4 excels.

Setting Up MetaTrader 4

Installing and Navigating the Platform

After downloading MT4 from your broker’s site, the setup process is straightforward. Once installed, sign in to your account to access a variety of features such as real-time charts, market quotes, and trading history. Familiarizing yourself with the interface early on is critical. Pay close attention to the “Market Watch” and “Navigator” panels, as they allow quick access to assets and tools.

Choosing the Right Indicators

MetaTrader 4 comes equipped with 30+ technical indicators, such as Moving Averages and Bollinger Bands. Selecting the right indicator depends on your strategy. For instance:

•Trend Followers might use Moving Averages to identify general price momentum.

•Range Traders often rely on tools like the Relative Strength Index (RSI) to spot overbought or oversold conditions.

Leveraging MT4 Features for Success

Automated Trading with Expert Advisors (EAs)

EAs are a unique MT4 feature that enables automated trading based on predetermined algorithms. This removes emotional trading and ensures consistent execution of strategies. While many traders customize their EAs, the MT4 marketplace offers pre-built solutions for a variety of trading styles.

Custom Charting Tools

MetaTrader 4’s customization options allow traders to tailor charts to their preferred timeframes or assets. Using templates for different strategies can save time and provide better insights during high-pressure trading sessions.

Risk Management with MT4

No trading strategy is complete without risk management. MT4 supports features like stop-loss and take-profit orders that minimize potential losses while locking in profits. Regularly monitoring your trade history via MT4’s “Terminal” section can also help in refining your strategy over time.

Ultimately, MT4 offers a well-rounded suite of tools designed for every level of forex trader. By mastering its features and integrating disciplined strategies, traders can greatly enhance their potential for success.